With the latest fintech statistics, it’s clear that going into banks is becoming a thing of the past. The global fintech market is growing, and you need to know how to reach consumers in this competitive environment.

Fintech disrupted the financial industry and became a multi-billion dollar sector that continues to grow at an exponential rate.

Some experts predict that the fintech market will grow to over $37 billion by 2026.

Whether moving money on your banking app, sending money to a friend to split the dinner bill, or paying for coffee with the tap of a phone, people from all generations are using fintech.

If you’re in the business of fintech content marketing, knowing the latest statistics and trends will help you know which audiences to target and where your content can stand out.

We’ll discuss how much the industry is worth, bitcoin and blockchain statistics, COVID-19’s impact on fintech, and much more.

Table of Contents:

- Key Fintech Data Points

- Fintech Industry Statistics

- Fintech Investment Statistics

- Fintech Blockchain Statistics

- Global Fintech Trends

- COVID-19’s Impact on Fintech

- Fintech Statistics for the Underbanked

- Consumer Experience in Fintech

- Fintech on Mobile Platforms

- Fintech and Artificial Intelligence

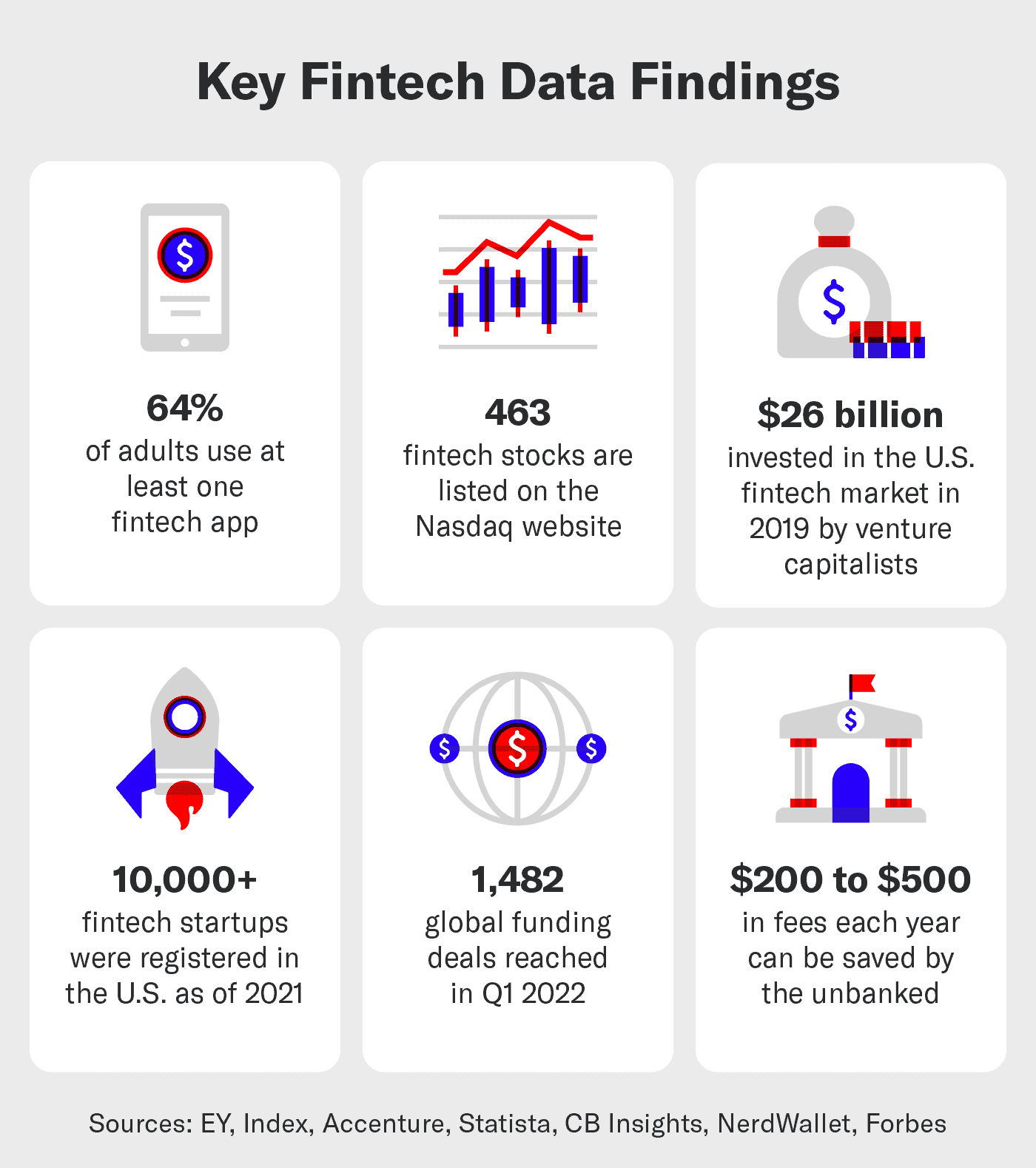

Key Fintech Data Points

If you’re not in the world of finance, you might be asking, “What is fintech?” In short, fintech is the financial technology that allows us to move money with ease.

Fintech is the home to a variety of services that you most likely use on a weekly or even daily basis. When you use an app to send a friend money, use mobile banking, or buy crypto, you’re using fintech.

Fintech is also an important market for the SEO and marketing industry. With so many venture capitalists funding fintech startups, these businesses are going to use some of that budget on marketing to get the word out.

Not only is the use of fintech growing around the world, it’s also improving customer experience and helping those who are unbanked. These trends show more and more people are beginning to leave traditional financial services behind in lieu of the convenience of technology.

- 64% of the global population used at least one fintech app in 2019. (EY)

- The Nasdaq stock exchange hosts the stocks for the biggest technology companies in the world. The Nasdaq currently has results for 463 fintech stocks. (Nasdaq)

- The United States fintech market received $26 billion worth of venture capital deals in 2019, which was a 54% year-over-year increase. (Accenture)

- The total number of global fintech funding deals in Q1 2022 was 1,482, an almost 20% increase from Q1 2021. (CB Insights)

- As of 2021, there were over 10,000 fintech startups registered in the United States alone, and over 26,000 globally. (Statista)

- The 9 million unbanked households in the U.S. pay an average of roughly $200 to $500 in annual fees for financial services like check cashing. Fintech helps people avoid these fees via digital direct deposit. (NerdWallet and Forbes)

Fintech Industry Statistics

The fintech industry is growing around the world, while more and more startups receive massive amounts of venture capital funding.

Currently, the United States is the largest home to fintech startups, but Asia isn’t far behind.

How Much Is the Fintech Industry Worth?

In 2022, there was over $25 billion worth of funding in the global financial services market.

While there’s not a solid number for how much the entire fintech industry is worth, the valuation trends and investments from venture capitalists we cover can help indicate how much the industry is worth.

- Financial analysts estimate that the global financial services market will be worth over $25,839 billion by 2022. (ReportLinker)

- In 2019, there was quite a bit of funding going into the United States fintech market with the value of deals increasing by 54% to over $26 billion. (Accenture)

- Research estimates that banks will save roughly $7.3 billion by 2023 by using chatbots. (Juniper Research)

- Investments in insurance fintech companies reached a five-year high in 2020 with over $3.8 billion raised in funding. (S&P Global)

- Due to the rough economic start of 2022, the global fintech funding dropped 33% quarter-over-quarter in Q2. (CB Insights)

How Much Is Fintech Growing?

If you need proof that fintech is outgrowing traditional financial services, Econsultancy and Adobe showcase this in a 2021 study. When surveying finance and insurance firms, they found that 54% said fintech was outgrowing their legacy services. Survey participants also said legacy systems and a lack of digital skills held back customer experience.

The fintech industry is broken up into various sectors, and the top fintech companies provide a variety of different services. Sectors include digital payments, lending, insurance, banking, and more.

According to the FDIC, the use of mobile banking continues to be the preferred banking method over going to the bank. Mobile banking use rose 9.5% in 2015, 15.6% in 2017, and 34% in 2019.

With so many people turning to mobile banking and fintech, it’s more important for financial services companies to invest in digital marketing like SEO.

- Digital peer-to-peer (P2P) lending was worth $3.5 billion in 2013 and is expected to reach $1 trillion by 2025. (Statista)

- Between Q1 of 2021 and Q4 of 2022, it’s expected that the global financial services market will grow by over $2.5 trillion. (ReportLinker)

- By 2021, North America grew to the second-largest financial services market, and Western Europe was the largest. (ReportLinker)

- 48% of financial institutions have fully embedded fintech into their strategic operating model. (PWC)

- Between 2020 and 2021, partnerships between banks and fintech companies grew 13% in the United States. (Statista)

- EMV chips are a security standard for debit, credit, and prepaid cards, and there were over 10.8 billion used by 2020, according to EMVCo. The use has grown between 60 to 70% in regions like Canada, Africa, Latin America, and more. (ReportLinker)

- The 2022 Financial Services Global Market report predicts that the market will grow at a compound annual growth rate of 9.6% to $37,343 billion in 2026. (ReportLinker)

Fintech Startup Statistics

There’s a lot of venture capitalist money flowing into fintech startups, and it’s most likely due to many of the best fintech companies seeing so much growth.

Not only has there been a sharp rise in users turning to fintech, but more people are searching for modern ways to manage their money.

- As of 2021, there were over 10,000 fintech startups registered in the United States alone and over 26,000 globally. (Statista)

- There were 19 insurtech IPOs in 2021 with a value of over $5 billion. (S&P Global)

- Robinhood had 500,000 users in 2014 and reached nearly 23 million by Q2 of 2022. (Statista)

- The U.K.-based Money management platform GoHenry has over 1 million paying customers and saw a 1,260% increase in search growth between 2018 and 2022. (Exploding Topics)

- M1 Finance is one of the top-rated startups with over 35,000 five-star reviews, and they received $323 million in series E funding. (Exploding Topics)

- The fintech startup Revolut has received over $1.7 billion in funding. (Exploding Topics)

- In 2021, Robinhood had over 9.1 million active users, which was triple the second-largest stock trading platform, WeBull. (Statista)

Fintech Investment Statistics

Many analysts and experts have been pointing to fintech stocks as great buys as more people begin to adopt the technology.

Market gurus like Cathy Wood are investing quite a bit in fintech stocks, with her exchange-traded fund (ETF) ARKF owning over 630,000 shares.

As people continue to use fintech, they’re using search engines like Google to find services, which is why SEO is crucial to any marketing campaign. As mentioned, there are 463 fintech results listed on the Nasdaq website, and many startups are getting millions in investment funding to contribute to their marketing.

Fortunately, regardless of your company’s size, you can break through the competition and be who customers first see when searching for fintech services on Google by utilizing SEO.

- The Nasdaq stock exchange hosts the stocks for the biggest technology companies in the world. The Nasdaq currently has results for 463 fintech stocks. (Nasdaq)

- Valued at $95 billion, Stripe is the largest fintech company in the United States. (Statista)

- ARK Invest has one of the largest fintech ETFs with over 630,000 shares spread across 31 different stocks. The ETF grew by 209% at its all-time high in 2021. (ARK Invest)

- When Coinbase went public in 2021, its market cap exceeded $100 billion on the Nasdaq. (CNBC)

- Between Q1 of 2022 and Q4 of 2021, Shopify’s stock share price rose 214%. (Yahoo! Finance)

- The former CEO of Twitter, Jack Dorsey, owns 50.8 million shares of the fintech company Square, oris 12.7% of total shares outstanding. (Whale Wisdom)

Venture Capitalist Funding in Fintech

Venture capitalists who didn’t get in early of fintech startups had a massive amount of regret, and now there are billions of dollars flowing into this industry.

Around the world, we’re seeing major increases in funding across all of the fintech verticals.

- Global fintech funding in Q2 of 2022 was $20.4 billion, a decrease of 33% QoQ from Q1, but funding was still up over 112% since 2018. (CB Insights)

- Startup and early-stage deals made up 90% of venture capital deals over time and across regions between 2010 and 2021. (Bank for International Settlements)

- The wealth tech sector saw a 36% QoQ increase in funding in 2022 with over 180 deals secured. (CB Insights)

- The value of global venture capital investment in fintech companies rose from 48.9 billion to 131.5 billion between 2020 and 2021. (Statista)

- There was a total of over 1,200 venture capital deals in Q2 of 2022. (CB Insights)

- In 2010, there was a total of 600 deals with a value of roughly $11 billion. By 2019, there was over $218 billion in funding with nearly 5,000 individual deals. (Bank for International Settlements)

Fintech Blockchain Statistics

The blockchain is where hundreds of thousands of cryptocurrency transactions take place on a daily basis.

But blockchain technology is more than just trading cryptos like Bitcoin and Ethereum.

The blockchain is a safe and secure technology and can help the 7.1 million unbanked American households who can’t access traditional financial institutions. Additionaly, blockchain technology is used by some of the biggest companies in the world like IBM, Microsoft, Intel, Goldman Sachs, and Walmart.

- 40% of financial services companies believe blockchain technology will change how services are delivered. (PWC)

- Crypto exchange KuCoin, one of the 20 fintech unicorns born in 2020, is valued at over $10 billion. (CB Insights)

- In 2020, the total global investment in blockchain and cryptocurrency companies was $1.2 billion. (KPMG)

- In 2019, there were over 450,000 transactions in a single day, which was 49% higher than the previous year. (YCharts)

- It’s estimated that 10% of people around the globe own some form of cryptocurrency. (Finbold)

- Worldwide spending on blockchain solutions was $6.6 billion in 2021, and it’s projected to reach $19 billion by 2024. (Statista)

How Many Bitcoins Are There?

Bitcoin is a deflationary currency, which means that there’s a limited number of them that will ever be created.

Once 21 million Bitcoins are mined, no more can be created, unlike fiat currencies that governments around the world can create.

- There were 18.74 million bitcoins in circulation as of June 2021. (Statista)

- By June of 2021, there were also over 74 million blockchain wallet users. (Blockchain.com)

- The number of bitcoin millionaires in the world reached 100,000 in February 2021. (BitInfoCharts.com)

- Bitcoin’s market cap was $465 billion as of Q3 of 2022. (Ycharts)

- The second-largest cryptocurrency, Ethereum, grew from $11.95 to $4,644.43 per coin in five years, which is a 38,765% increase. (Coin Market Cap)

- Over 3 million people were trading cryptocurrencies on the Robinhood app in Q1 of 2021. (Buy Bitcoin Worldwide)

- At the end of its IPO day, the crypto exchange Coinbase closed at $328.28 per share on the Nasdaq, valuing it at $85.8 billion. (Yahoo! Finance)

Global Fintech Trends

Although the United States is the world leader in the fintech market, we’re seeing more countries begin to use fintech.

Countries from the United Kingdom to India, Singapore, and beyond are receiving funding as people turn to digital financial services.

- Throughout 2021 up to Q2 of 2022, the United States had the most fintech funding with 38% of global deals taking place in the U.S. by the end of the quarter. (CB Insights)

- 75% of financial institutions are hiring staff and creating jobs related to fintech. (PWC)

- The rise of fintech funding during 2019 in the United States made experts analysts believe that investors remained confident about future growth. (Accenture)

- Fintech investments rose 63% to $6.3 billion in the United Kingdom during 2019. (Accenture)

- Fintech fundraising in India almost doubled to $3.7 billion in 2019 and had larger gains in Singapore, which grew to $861 million. (Accenture)

- In Q2 of 2022, 24% of fintech funding deals went to Asia, making it the second-largest regional deal share behind the United States. (CB Insights)

- Due to the economy, fintech funding hit a two-year low in Q2 of 2022 while still receiving over $20 billion in investments. (CB Insights)

- Most experts believe consumers around the world will be using fintech in preference to traditional banks. (CB Insights)

Research from Deloitte’s Fintech by the Numbers analysis showcases fintech’s exponential growth on a global scale as well as projected growth through 2024. The below data uses actual figures up to 2018.

| Year | Americas | EMEA | Asia Pacific | Total | YOY Increase |

|---|---|---|---|---|---|

| 2017 | $32 billion | $19 billion | $29 billion | $80 billion | – |

| 2018 | $38 billion | $20 billion | $35 billion | $92 billion | 15% |

| 2019 | $45 billion | $21 billion | $42 billion | $108 billion | 17.3% |

| 2020 | $54 billion | $23 billion | $49 billion | $126 billion | 16.6% |

| 2021 | $64 billion | $24 billion | $55 billion | $143 billion | 13.5% |

| 2022 | $74 billion | $26 billion | $58 billion | $159 billion | 11.1% |

| 2023* | $85 billion | $28 billion | $58 billion | $174 billion | 9.4% |

| 2024* | $96 billion | $29 billion | $63 billion | $188 billion | 8% |

COVID-19’s Impact on Fintech

In the early months of the pandemic, there was a 72% rise in the use of fintech apps in Europe due to lockdown orders that attempted to limit the spread of COVID-19.

The lockdown forced more people to turn to fintech to manage their finances, make payments and more while having limited access to banks.

Throughout the pandemic, the World Economic Forum (WEF) conducted studies to specifically tease out data that showed how the pandemic impacted the fintech industry.

- Globally, every type of fintech vertical (digital lending, digital payments, insurtech, etc) grew in the first half of 2020 except one. (Global COVID-19 FinTech Market Rapid Assessment Study)

- Retail-facing fintech firms saw an average increase of 47% in gross values transacted in 2020. (Global COVID-19 FinTech Market Rapid Assessment Study)

- Digital payment and digital lending firms saw the largest growth during the pandemic. (https://www.weforum.org/reports/the-global-covid-19-fintech-market-impact-and-industry-resilience-study)

- 55% of the people using digital payments around the world during the pandemic were low-income. (Global COVID-19 FinTech Market Rapid Assessment Study)

Fintech Statistics for the Underbanked

There are millions of unbanked or underbanked Americans, and there are even more when looking through a global lens.

Unbanked and underbanked refer to those who don’t have access to traditional financial services like bank accounts.

These people have to turn to resources like money orders, check cashing services, payday advances, and more.

Fintech has become the solution for many people who are unbanked or underbanked. To understand how important fintech is for these populations, it’s helpful to understand how big this problem actually is.

- 13% of American adults are underbanked, and 5% are completely unbanked. (Federal Reserve)

- 16.1% of unbanked Americans don’t trust traditional banks. (FDIC)

- In 2016, the 9 million unbanked American households paid between $1.8 and $4.5 billion in fees due to a lack of access to traditional banks. (NerdWallet)

- Education level is a major determinant of being unbanked or underbanked, with 24% of the unbanked population having less than a high school degree. (Federal Reserve)

- Between 2021 and 2022, 10% of people had to use installment loan services, also known as “buy now, pay later.” (Federal Reserve)

- More than 21 million Americans, or 11% of the population, don’t have a government-issued I.D., making hit difficult or impossible to get a traditional bank account. (ACLU)

- People who are fully banked with the ability to borrow for a credit card are, on average, more prepared for financial disruptions. (Federal Reserve)

- People who are less educated, part of a racial or ethnic minority group, or are low-income are much more likely to be unbanked or underbanked. (Federal Reserve)

- Almost 50% of people making less than $50,000 per year were denied on credit applications, compared to 11% for those making over $100,000. (Federal Reserve)

- Black and Hispanic people from all income levels are more likely to be denied for credit or approved for a lesser amount. This includes those making $100,000 or more. (Federal Reserve)

- It’s estimated that the annual cost of those who don’t have a bank account is $196.50 per year due to prepaid debit card fees. (NerdWallet)

Consumer Experience in Fintech

One of the most important trends to keep an eye on is the fact that more people are exclusively using fintech.

For those in the financial services industry, this is crucial so you know where to invest your time and resources. It’s also important so you’re spending your marketing dollars in the right place.

- 94% of financial services executives believe fintech will improve customer experience and lead to revenue growth in the future. (PWC)

- Over 25% of financial services companies believe fintech’s ease of use and faster service and processes will lead to better customer retention. (PWC)

- 56% of people without a bank account were not interested in getting a checking or savings account in the future. (FDIC)

- Individuals who only use cash have an annual cost of about $198.83 due to fees from check cashing and money order services. (NerdWallet)

- Young people trust fintech companies much more than banks with 51% of 18 to 24-year-olds and 49% of 25 to 34-year-olds trusting fintech, while only 39% and 42% trust banks, respectively. (Statista)

- In 2021, mobile payments were the primary source of in-store point of sale transactions at 30% with only 18% of people using cash. (Hotel Tech Report)

- A consumer report from Experian shows that 56% of consumers are willing to share contact information and 42% would share personal data with financial institutions if it would improve their experience. (Experian)

Fintech on Mobile Platforms

The majority of people spend at least five to six hours on their phones each day, and 11% of people spend seven hours or more on their device.

With people using their mobile devices this much, it’s no wonder that over half of the adults in America use fintech apps. More people are using fintech to send money to friends, pay their bills, and much more.

- 64% of the global population used at least one fintech app in 2019. (EY)

In the 2020 fiscal year, the mobile payment platform Zelle’s payment volume was over $307 billion, almost double PayPal and Venmo. (Statista) - In 2022, 97% of millennials said they use mobile banking. (Insider Intelligence)

- 58% of people said they’re visiting bank branches less, and 61% say they’re using mobile banking apps more frequently. (S&P Global)

- The majority of Gen Z and Gen Y are using mobile banking, with 51% of Gen Z and 64% of Gen Y using it to check their balances and activity. (Morgan Stanley)

- Roughly 39% of consumers say they shop from their mobile device daily or weekly, and 23% say they shop from their phones daily. (Global Payments)

- The most popular payment apps to pay bills and send or receive money are PayPal (59%), banking apps (41%), and Google Wallet (20%). (S&P Global)

- Mobile app app spending reached an all-time high of $170 billion in 2021 and dipped slightly to $167 billion in 2022. (Statista)

Fintech and Artificial Intelligence

Some people don’t think of artificial intelligence (AI) when discussing fintech, but roughly 90% of global fintech companies are using it today.

The largest fintech companies in the world use AI and machine learning to help with fraud detection as well as for customer service via chatbots.

- B2B businesses are 24% more likely than B2C to use AI content generation tools. (Siege Media + Clearscope)

- The AI fintech global market size is expected to grow 25% between 2021 and 2022 to $9.13 billion. (The Business Research Company)

- Roughly 90% of global fintech companies are already heavily relying on artificial intelligence and machine learning. (University of Cambridge)

- It’s estimated that the use of artificial intelligence will save the insurance industry almost $1.3 billion by 2023. (Juniper Research)

- Fraud detection systems powered by AI or machine learning algorithms are estimated to minimize the time of fraud investigations by 70%, while increasing accuracy by 90%. (The Business Research Company)

How To Grow Your Fintech Business

Whether you’re in the business of fintech or looking to create a fintech branch of your financial services business, you now know how massive the fintech industry has become.

More importantly, there’s no sign that its growth is going to slow down any time soon. With billions of dollars of investments each quarter and so many people using fintech, you don’t want your business to be left behind.

The primary way people discover the capabilities of fintech and which services to use is through search engines. When people are looking into apps and other digital services to suit their financial needs, you want to be sure that you’re what’s showing up on the first page of Google.

Siege Media has a decade of experience helping companies increase their web presence through content marketing and keeping up with the latest in Google algorithm updates.

To learn more about how Siege can help you and your fintech company, contact us today for an SEO consultation.